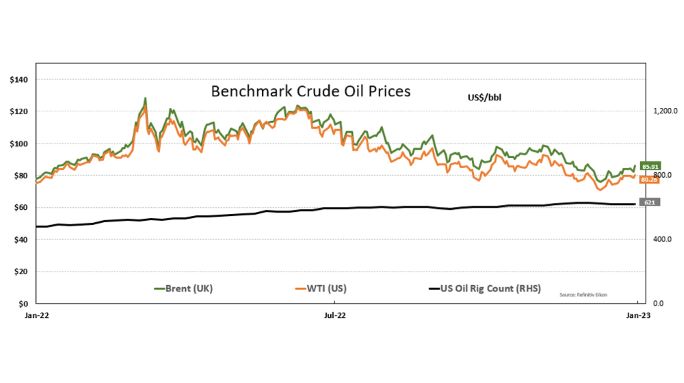

Oil prices swung wildly in 2022, climbing on tight supplies amid the war in Ukraine, then sliding on weaker demand from top importer China and worries of an economic contraction, but closed the year on Friday with a second straight annual gain. Prices surged in March as Russia’s invasion of Ukraine upended global crude flows, with international benchmark Brent reaching $139.13 a barrel, the highest since 2008.

Prices cooled rapidly in the second half as central banks hiked interest rates and fanned worries of recession. Brent crude on Friday, the last trading day of the year, settled at $85.91 a barrel up by $2.45 per barrel. US WTI closed at $80.26 a barrel up by $1.86. For the year, Brent gained about 10 percent, after jumping 50 percent in 2021.

US crude rose nearly 7 percent in 2022, following last year’s gain of 55 percent. Both benchmarks fell sharply in 2020 as COVID-19 slashed fuel demand.

Asian spot LNG prices slid for a second consecutive week, dragged down by healthy inventory levels in both Asia and Europe amid a relatively mild winter, while also recording an annual decline. The average LNG price for February delivery into northeast Asia ended the year at $28 per mmBtu, down $3, or 9.7 percent, from the previous week, industry sources estimated.

On an annual basis, Asian LNG prices were down 17% after two years of strong gains of over 100 percent, capping a year of volatility following Russia’s invasion of Ukraine and its move to cut gas supplies to Europe. Global gas prices had surged to record levels as Europe imported record cargoes of LNG to compensate for cuts in pipeline supplies. Asian LNG prices spiked to historical highs of $70.50 mmBtu in late August ahead of a key pipeline outage, before easing for the rest of 2022 on ample stockpiles in Europe and key North Asian markets. According to Gas Infrastructure Europe data, Europe’s gas storage sites were 83.2% full overall, with the region’s biggest consumer Germany seeing filling levels of 88.2%. In the US, natural gas futures on Friday slipped to a 10-month low on forecasts for warmer weather, yet the contract rose for third consecutive year.

Source and image credit: The Peninsula.