General Tax Authority Extends Application Deadline for Financial Penalty Exemption Initiative Until 31 December 2025

The General Tax Authority (GTA) announced the extension of the submission period for the initiative until December 31, 2025. The General Tax Authority of Qatar has extended the deadline for its 100% financial penalty exemption initiative until December 31, 2025, in response to strong interest. The initiative allows taxpayers to resolve overdue tax issues without penalties via the Dhareeba platform. So far, it has resulted in: The initiative supports voluntary compliance, improves trust between taxpayers and the Authority, and boosts the overall effectiveness of the tax system.

100% Financial Penalty Exemption Initiative / Act Now & Apply

What’s the 100% Financial Penalty Exemption Initiative? The Conditional 100% Financial Penalty Exemption Initiative aims to support and encourage taxpayers to voluntarily comply with tax obligations and assist them in easily and conveniently regularizing their tax status. The initiative significantly enhances the efficiency of the State of Qatar’s tax system, thereby promoting a culture of mutual trust and cooperation between taxpayers and the General Tax Authority.The initiative offers full exemption from all financial penalties under the Income Tax Law Promulgated by Law No. (24) of 2018 and its amendments, and Law No. (25) of 2018 on Excise Tax. Duration of the Initiative: The initiative will be valid for a period of 6 months, commencing from March 1 2025. Eligibility for the 100% Financial Penalty Exception Initiative: To enjoy the benefits of the initiative, the taxpayer must register on the Dhareeba Platform and ensure the accuracy of registration details, including: The taxpayer must also ensure the following conditions are met: Note: If the taxpayer doesn’t meet any of the above conditions, they won’t be able to enjoy the benefits of the initiative. The following conditions and enterprises are excluded from this initiative:

Qatar’s Economy 2025

Executive Summary In January 2025, Qatar’s economy demonstrated resilience amid global uncertainties. The Qatar Stock Exchange (QSE) Index experienced modest growth, closing at 10,485.7 on January 7, 2025, with notable performances in the Telecoms and Consumer Goods & Services sectors. Zad Holding Company and Vodafone Qatar were among the top gainers, rising 7.5% and 2.3%, respectively. qnb.com The country’s Gross Domestic Product (GDP) is projected to gradually recover in 2025, driven by modest increases in both hydrocarbon and non-hydrocarbon activities. Sectors such as construction, tourism, retail, and finance are expected to support this growth. The expansion of the North Field, the world’s largest natural gas field, is anticipated to boost the hydrocarbon sector, with total production expected to increase by 1% in 2025. coface.com Political Developments Qatar continues to enhance its diplomatic relations within the region. In early January, Syria’s new foreign minister visited Doha to establish diplomatic ties with Qatari officials. This visit signifies Qatar’s ongoing commitment to regional stability and cooperation. apnews.com Legal Reforms To attract foreign investment, Qatar is drafting new legislation, including a bankruptcy law, a public-private partnership law, and a commercial registration law. These reforms aim to create a more business-friendly environment and are part of a comprehensive review of 27 laws across 17 ministries, affecting over 500 activities. The government has set a target to attract $100 billion in foreign direct investment by 2030. reuters.com Market Dynamics The Qatar Investment Authority (QIA), managing assets worth $500 billion, plans to engage in larger and more frequent deals ahead of an anticipated windfall from expanded liquefied natural gas (LNG) production. The QIA is focusing on investments in technology, artificial intelligence, healthcare, real estate, and infrastructure, particularly in the U.S., U.K., and Asia. ft.com In the aviation sector, Virgin Australia has received interim authorization from the Australian Competition and Consumer Commission to sell tickets on Qatar Airways-operated flights to Doha. This partnership is expected to double Qatar Airways’ capacity into Australia, enhancing connectivity and offering more options for travelers. theaustralian.com.au Conclusion January 2025 has been a pivotal month for Qatar, marked by strategic economic initiatives, significant legal reforms, and strengthened regional diplomacy. These developments underscore Qatar’s commitment to diversifying its economy, enhancing its global investment footprint, and fostering regional cooperation.

Qatar’s Economy 2024

Executive Summary In October 2024, Qatar’s economy demonstrated moderate growth with substantial resilience in its key sectors, particularly in natural gas, despite ongoing global market volatility. Real GDP growth is expected to stabilize at around 2.2% for 2024, supported by Qatar’s North Field gas expansion and diversification efforts. Inflation remains low, around 1.2%, easing cost pressures across sectors. Politically, Qatar continues to enhance international relations, particularly through LNG trade partnerships with China. Legal reforms are fostering a more attractive environment for foreign investors, with a focus on simplified compliance procedures. Continued expansion in infrastructure and real estate, notably through new commercial and residential projects, reflects Qatar’s broader vision to diversify its economy. Key recommendations include monitoring regulatory changes, particularly for compliance, and capitalizing on emerging green energy opportunities. Economic Overview GDP Growth: Real GDP growth for 2024 is projected at 2.2%, supported by stable gas output and non-hydrocarbon sector activities like financial services and construction. Industrial production has shown intermittent performance with some monthly contractions; however, the non-energy PMI indicates an improving business environment Inflation Rates: Inflation is currently low, estimated at 1.2% as of October 2024, following a year-long trend of price stability. Declines in global food and commodity prices have helped keep costs manageable for businesses and consumers Unemployment Rates: Unemployment remains at one of the lowest global levels, around 0.2%. The expanding private sector and government hiring in health and education sectors are expected to sustain employment stability Key Economic Indicators: Oil & Gas: The sector remains crucial, with LNG exports expected to rise due to recent deals with China and expansion projects in the North Field. Construction: Activity remains robust, though large projects are tapering off as many are nearing completion post-World Cup. Services: Financial and insurance services continue to drive growth within the non-hydrocarbon sectors, indicating diversification progress Political and Regulatory Updates Government Policies: Qatar’s government has prioritized environmental sustainability, investing in green energy projects and aiming for a 5 GW solar capacity by 2035. Government spending on health and education has increased in the 2024 budget, reflecting an ongoing commitment to human capital development Regulatory Changes: Recently implemented tax incentives and relaxed foreign ownership laws in certain free zones aim to attract greater foreign direct investment. Amendments to labor and business regulations also simplify compliance for foreign companies operating within the Qatar Financial Centre (QFC) International Relations: New partnerships, including QatarEnergy’s contracts with Chinese firms for LNG infrastructure, emphasize Qatar’s strategic role in Asia’s energy security. The Friendship Bridge with Bahrain and potential rail links with Saudi Arabia further boost regional connectivity Market Analysis Industry Performance: Sectors like transport, retail, and manufacturing have shown growth. Qatar’s PMI rose in Q3, indicating that non-energy sectors are expanding. High activity in logistics and infrastructure development highlights the country’s efforts to position itself as a trade hub Market Opportunities: Green hydrogen and sustainable aviation fuels present emerging market opportunities, with growing demand anticipated across the region. The government’s support for renewable projects aligns with global sustainability goals, making it a prime area for investmen Competitive Landscape: Qatar’s focus on strengthening its energy sector while expanding logistics capabilities sets it apart from regional competitors. Continued investments in free zones and regulatory adjustments could further attract foreign businesses, enhancing its competitive positioning Legal and Compliance Updates New Legislation: Recent legislative adjustments include tax reliefs for renewable energy projects and expanded foreign ownership rights in certain sectors. These changes are geared towards enhancing Qatar’s business appeal to foreign entities Compliance Requirements: Amendments to labor laws necessitate regular compliance audits for firms employing foreign workers, ensuring adherence to new employment standards. Simplified tax filing processes have also been introduced to reduce administrative burdens Risk Assessment: Businesses should stay alert to potential regulatory shifts in environmental compliance, particularly as Qatar strengthens its environmental policies to align with international standards Human Resources and Labor Market Employment Laws: Labor law amendments aim to improve workers’ rights, including better wage protections and expanded grievance mechanisms, particularly for foreign labor in construction and service sectors Labor Market Trends: Qatar’s demand for skilled labor remains strong, with an increased focus on STEM fields and healthcare roles. Demand is partially driven by infrastructure projects and government investment in health and education Talent Acquisition: While high employment rates benefit stability, the limited local talent pool in some sectors poses challenges for firms, especially those needing specialized skills Infrastructure and Real Estate Developments Major Projects: Expansion at Hamad Port and new commercial real estate developments are underway. Projects linked to logistics and transport infrastructure, such as the Hamad International Airport expansion, emphasize Qatar’s goal to be a trade hub Real Estate Trends: Demand for residential and commercial properties remains high. Investment in urban development and commercial spaces aligns with anticipated population growth and rising FDI Cultural and Social Insights Cultural Events: October 2024 saw several cultural festivals aimed at promoting tourism. Events celebrating traditional Qatari heritage and contemporary art foster cultural awareness and attract foreign visitors Social Trends: Rising adoption of digital services and e-commerce trends have influenced the retail and logistics sectors, pushing companies to optimize digital offerings References World Economic Outlook Database, October 2024 – IMF: https://www.imf.org Qatar Economy Watch 2024 – PwC: https://www.pwc.com Qatar Economy: GDP, Inflation, CPI & Interest Rates – FocusEconomics: https://www.focus-economics.com Social, Economic, Environmental Changes and Diversification in Qatar – Oxford Business Group: https://www.oxfordbusinessgroup.com Qatar’s 2024 Budget and Fiscal Policy – Ministry of Finance Qatar: https://www.mof.gov.qa Qatar PMI and Non-Energy Sector Performance – Qatar Financial Centre: https://www.qfc.qa Qatar’s LNG Agreements and Energy Partnerships – QatarEnergy: https://www.qatarenergy.qa Green Hydrogen and Renewable Energy in Qatar – PwC Middle East: https://www.pwc.com IMF Country Report on Qatar’s Economic Forecasts – IMF Publications: https://www.imf.org Qatar’s Legal and Business Environment – Oxford Business Group: https://www.oxfordbusinessgroup.com

Qatar Launches Residence Permit Initiative Targeting Skilled Talents

This initiative is part of the nation’s strategy to broaden its economic base and establish itself as a premier destination for investors. Doha: Qatar’s government has unveiled a new residence permit scheme aimed at skilled professionals and business innovators, granting them the privilege to live and work in Qatar for an initial period of five years, with the option for extension. This innovative residence permit provides international talents with a pathway to long-term residency and investment in Qatar, emphasizing the nation’s ongoing commitment to attracting and nurturing skilled professionals and entrepreneurs. These individuals are seen as pivotal in driving economic expansion and fostering innovation within the country. Applications for this residence permit program are slated to open in the coming months. Eligibility Requirements For the Talent Category: Candidates must secure an endorsement from a recognized Qatari government body, identifying them as talented individuals within one of 13 specified sectors, including the arts, sports, education, scientific research, and innovation. Additionally, applicants must either possess a job offer or an employment agreement with a Qatari employer, or demonstrate financial self-sufficiency with a minimum of QAR 36,500 (around USD 10,027) to cover their initial stay in Qatar during the immigration process. For the Entrepreneur Category: Aspiring entrepreneurs must present a viable business proposal approved by a certified business incubator in Qatar, such as the Qatar Science & Technology Park or Qatar Fintech Hub. The proposed investment must be at least QAR 250,000 (approximately USD 68,671). This new initiative is in line with Qatar’s strategic vision to diversify its economy and craft an investor-friendly ecosystem. It positions Qatar as an attractive hub for foreign investments and a nurturing ground for skilled talent.

Navigating the Immigration Process & Employment Challenges in Qatar

Qatar, a rapidly developing country in the Middle East, has become an attractive destination for expatriates seeking employment opportunities. However, navigating the immigration process and overcoming employment challenges can be a daunting task for those wishing to work in this Gulf nation. In this article, we will explore the immigration process in Qatar and discuss strategies to overcome employment challenges faced by expatriates. Introduction to the Immigration Process in Qatar The immigration process in Qatar involves several steps that need to be followed diligently to ensure a smooth transition into the country. Expatriates must first obtain a work visa, which is typically sponsored by their employer. This requires the employer to submit various documents, including a copy of the employee’s passport, educational certificates, and a letter of employment. Once the visa is approved, the employee can enter Qatar and begin the process of obtaining a residency permit, commonly known as an ID card. To obtain a residency permit, expatriates must undergo a medical test and provide additional documents such as a rental agreement or proof of ownership of accommodation, as well as a valid employment contract. It is essential to ensure that all paperwork is complete and accurate to avoid any delays or complications in the immigration process. It is also worth noting that employers in Qatar often handle the immigration process for their employees, making it crucial for individuals to establish clear communication and coordination with their employers. Overcoming Employment Challenges for Expatriates in Qatar Expatriates often face unique employment challenges when working in Qatar. One of the most common challenges is the language barrier. Arabic is the official language of Qatar, and although English is widely spoken in business settings, having some knowledge of Arabic can be advantageous. Expatriates who take the initiative to learn Arabic or engage in language courses will have an advantage in finding better job opportunities and adapting to the local work culture. Another challenge is the competition for jobs. Qatar has a large expatriate population, and many individuals from around the world are vying for limited job positions. To overcome this challenge, it is crucial for expatriates to differentiate themselves by acquiring specialized skills and qualifications that are in high demand. Continuous professional development and keeping up with industry trends are essential to remain competitive in the job market. Expatriates should also familiarize themselves with the labor laws and regulations in Qatar, as they differ from those in their home countries. Understanding employment contracts, working hours, and rights as an employee is essential to protect oneself from any potential employment disputes. Seeking legal advice or guidance from professionals who specialize in Qatari labor laws can be beneficial in navigating these challenges. While the immigration process and employment challenges in Qatar may seem overwhelming, with proper planning and preparation, expatriates can successfully navigate these hurdles. By understanding the immigration process, overcoming language barriers, acquiring specialized skills, and staying informed about employment regulations, expatriates can make the most of their employment opportunities in Qatar. With its growing economy and diverse work environment, Qatar remains a promising destination for those seeking new horizons in their careers.

Qatar Insurance Company Introduces The Fastest Online Solution to Get Mandatory Visitor’s Insurance in Qatar

International visitors can now get their Mandatory Visitors’ Health Insurance policy in less than 2 minutes on qic.online and from anywhere in the world prior to their trip to Qatar. All they need to do is to select the duration of their stay in Qatar, add their personal details and pay online without any need to scan or submit any document. With a Mandatory Visitor’s Health Insurance plan by QIC, visitors can benefit from a solid financial protection in case of emergency medical treatments and emergency medical assistance in Qatar. The insurance also covers the visitor’s medical expenses in case of getting ill in Qatar due to a COVID-19 infection, emergency evacuation to the insured’s home country, and the repatriation of remains. QIC’s mandatory visitors’ health insurance is available at a premium fixed at QAR 50 per policy, and visitors with Hayya Cards can get a long-term plan valid until January 2024. There are no age limits on getting a QIC health insurance for visitors and travelers of all ages can get it, including senior visitors. Mr. Ahmed Al Jarboey, QIC’s Chief Operating Officer – Qatar Operations, said: “Rolling out this new online solution reflects our commitment at Qatar Insurance Company to fully support the recently implemented Health Insurance Scheme in Qatar, and to offer easy access to quality healthcare services to everyone in Qatar. Our newest digital product is designed to offer the most convenient insurance experience to all visitors, and we are confident that it will help make every visitor’s stay in Qatar safer and more enjoyable.” For a hassle-free experience, QIC offers a comprehensive customer support service available all days of the week in different languages. QIC’s contact center can be reached via hotline number 8000 742, or WhatsApp number 5000 0742. For more information, please visit qic.online/en/visitors/

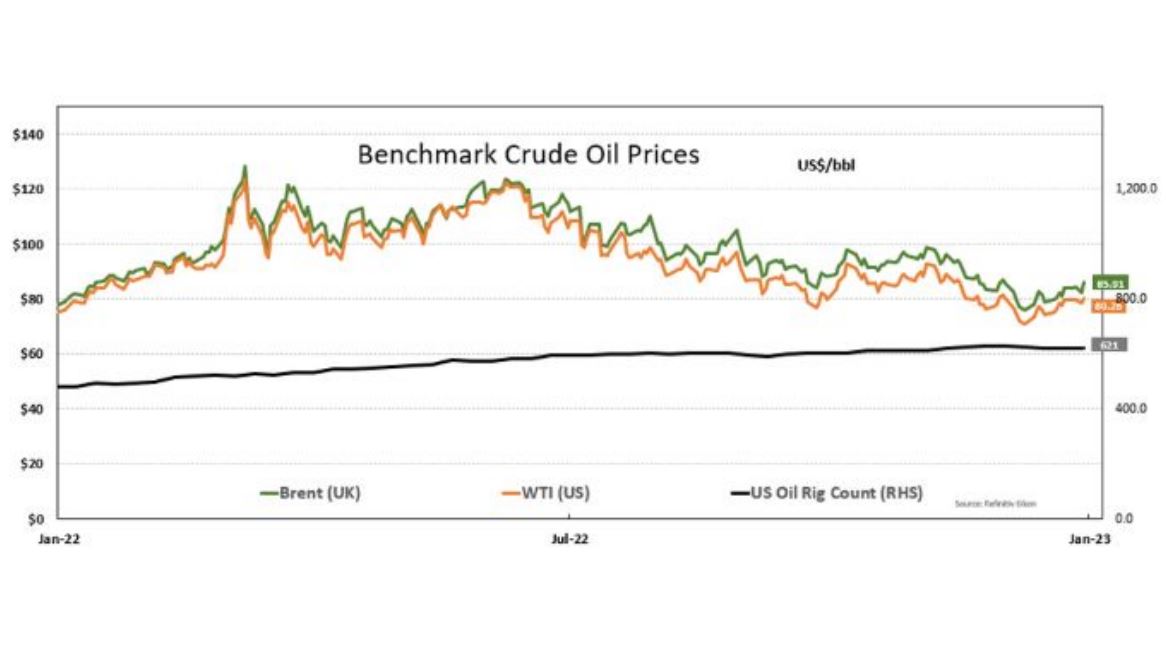

Oil ends volatile year with 2nd straight annual gain

Oil prices swung wildly in 2022, climbing on tight supplies amid the war in Ukraine, then sliding on weaker demand from top importer China and worries of an economic contraction, but closed the year on Friday with a second straight annual gain. Prices surged in March as Russia’s invasion of Ukraine upended global crude flows, with international benchmark Brent reaching $139.13 a barrel, the highest since 2008. Prices cooled rapidly in the second half as central banks hiked interest rates and fanned worries of recession. Brent crude on Friday, the last trading day of the year, settled at $85.91 a barrel up by $2.45 per barrel. US WTI closed at $80.26 a barrel up by $1.86. For the year, Brent gained about 10 percent, after jumping 50 percent in 2021. US crude rose nearly 7 percent in 2022, following last year’s gain of 55 percent. Both benchmarks fell sharply in 2020 as COVID-19 slashed fuel demand. Investors in 2023 are expected to keep taking a cautious approach, wary of interest rate hikes and possible recessions. Oil’s decline in the second half of 2022 as rising interest rates to fight inflation boosted the US dollar, making dollar-denominated commodities like crude more costly for holders of other currencies. Asian spot LNG prices slid for a second consecutive week, dragged down by healthy inventory levels in both Asia and Europe amid a relatively mild winter, while also recording an annual decline. The average LNG price for February delivery into northeast Asia ended the year at $28 per mmBtu, down $3, or 9.7 percent, from the previous week, industry sources estimated. On an annual basis, Asian LNG prices were down 17% after two years of strong gains of over 100 percent, capping a year of volatility following Russia’s invasion of Ukraine and its move to cut gas supplies to Europe. Global gas prices had surged to record levels as Europe imported record cargoes of LNG to compensate for cuts in pipeline supplies. Asian LNG prices spiked to historical highs of $70.50 mmBtu in late August ahead of a key pipeline outage, before easing for the rest of 2022 on ample stockpiles in Europe and key North Asian markets. According to Gas Infrastructure Europe data, Europe’s gas storage sites were 83.2% full overall, with the region’s biggest consumer Germany seeing filling levels of 88.2%. In the US, natural gas futures on Friday slipped to a 10-month low on forecasts for warmer weather, yet the contract rose for third consecutive year. Source and image credit: The Peninsula Qatar